SME's account for over 1 million employees, or 68.4% of total employment in the Irish business economy. As the extent of COVID-19 becomes apparent, and doors open back up, the key challenge faced by small businesses across the country is protecting their cash flow. SME's are vital to our local communities, many are looking to invest in essential equipment or the latest technologies to help them survive and grow.

Lynn O’Brien, is the Cork Branch Manager for grenke Ireland who work with thousands of SME's across Ireland tailoring the perfect financial solutions to fit their business plans. We sat down with Lynn to discuss some of the key challenges facing SME's, grenke’s commitment to funding SME growth, and how in particular, leasing could help the SME sector as it opens back up.

Q. What has been the impact of COVID-19 on the SME sector?

SME’s around Ireland have been hit hard by this pandemic, the impact has been significant and to an extent, the economy has been on hold for several months. Unprecedented pressure has been placed on SME’s and their operations, many businesses have sustained losses that are threatening their survival. It is certain that SME’s are vital for job creation here in Ireland, they employ a large proportion of the working population, essentially they are the backbone of our economy. Supporting the SME sector will be key to any overall economic recovery.

Q. What are the key challenges facing SME’s in this environment?

Working so closely with SME's we know that cash flow is one of their biggest challenges. Businesses have been in lock down since mid-March, this has created a huge financial burden. Without cash, you have no business, so effective cash flow management is more important than ever. The old phrase ‘cash is king’ comes to mind – protecting cash flow will allow businesses to balance fixed and operational costs alongside investments for equipment, infrastructure, and the latest technology, all of which are essential, not only to function but also to grow and survive.

Q. Tell us about grenke and Leasing.

grenke have been providing financing solutions for small and medium-sized enterprises since 1978. We work with our customers and partners across the country tailoring financial solutions to fit their business plans. We are in Ireland for over 16 years now, with our first branch having opened in Dublin in 2004. Whether you want to lease equipment or access invoice finance solutions, grenke can help. Our brand promise – ‘Fast. Forward. Finance.’ coupled with our digital solutions that enhance our personal service has made us one of the leading asset and invoice finance providers in the Irish market.

Leasing is an incredibly effective way of allowing a business to hold on to it’s cash while investing in business equipment for the future. We finance a wide array of different assets (from IT hardware to thermal imaging equipment) through our single lease option or our Master Lease Agreement, which allows you to lease a wide range of assets independently of each other over a 12-month period at fixed preferential rates. At grenke our fast, simple and personal approach is what sets us apart. Our secure online applications provides customers and partners with quick approval and same day responses. From as little as €500 you can lease your business equipment with grenke (even a €500 tablet or mobile POS system). Talk to grenke today.

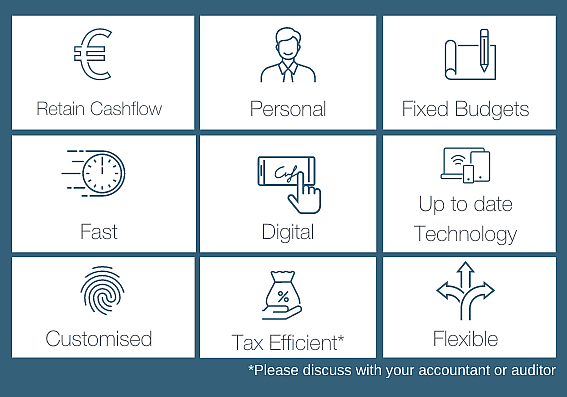

There are so many benefits to leasing with grenke:

Talk to us today on 01-292 3400 or email us at [email protected] to arrange an appointment.