All-inclusive Invoice Finance

Transferring receivables offers many benefits. With Classic Invoice Finance, you can enjoy them all.

Invoice Finance for your cashflow

Are you looking to grow, about to launch new projects or planning investments? Times like these are exactly when a reliable source of cashflow is enormously important. Have you ever thought about Invoice Finance for such occasions?

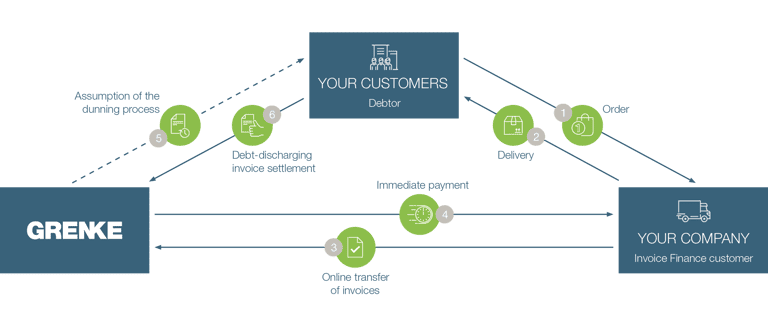

You issue the invoices; we’ll take care of the rest

Classic Invoice Finance is for all those who need cashflow and want to concentrate entirely on their actual work. Things like developing ideas, expanding the business and taking care of customers, rather than chasing collections, credit control or taking care of the debtor invoices.

We make it possible. With Classic Invoice Finance, we take on your complete invoice management.

You control the process and make decisions at any time that best suit your business.

How exactly does Invoice Finance work?

Is this what you need?

Not sure whether Invoice Finance is right for you? Find out with our Invoice Finance test.

Our Invoice Finance products

All three Invoice Finance products are pretty impressive, but what makes them different? Our comparison makes it clear.

Classic Invoice Finance

Flex Invoice Finance

Choice Invoice Finance

Assumption of complete accounts receivable management

Pre-financing for specific invoices

Pre-financing of selected accounts receivable

Credit checks for entire customer bases

Credit checks for selected accounts receivable

Choose experience

We are trusted by a wide range of entrepreneurs from small and medium-sized enterprises. One reason for that is that we are an SME ourselves. That has meant that over the decades, we have been able to build up longlasting strategic partnerships.

We know that speed and flexibility are crucial for you and your business. Our Invoice Finance products are tailored to suit your business needs allowing you space for development and growth.

Submit invoices online

Give Invoice Finance a try. It’s a quick process and there’s no commitment involved. With the grenke Cashflow Optimizer, you don’t even have to leave your desk.

Invoice Finance with grenke Cashflow Optimizer

Take the opportunity to give Invoice Finance with grenke a try – even if you just want to submit one invoice. It’s easy to submit your request and upload your invoice using our online tool.

Something else that may interest you

Everything under one roof: have a look at some other products from grenke.